Our Digital Marketing Blog

Digital Ideas Monthly

Sign up now and get our free monthly email. It’s filled with our favourite pieces of the news from the industry, SEO, PPC, Social Media and more. And, don’t forget - it’s free, so why haven’t you signed up already?

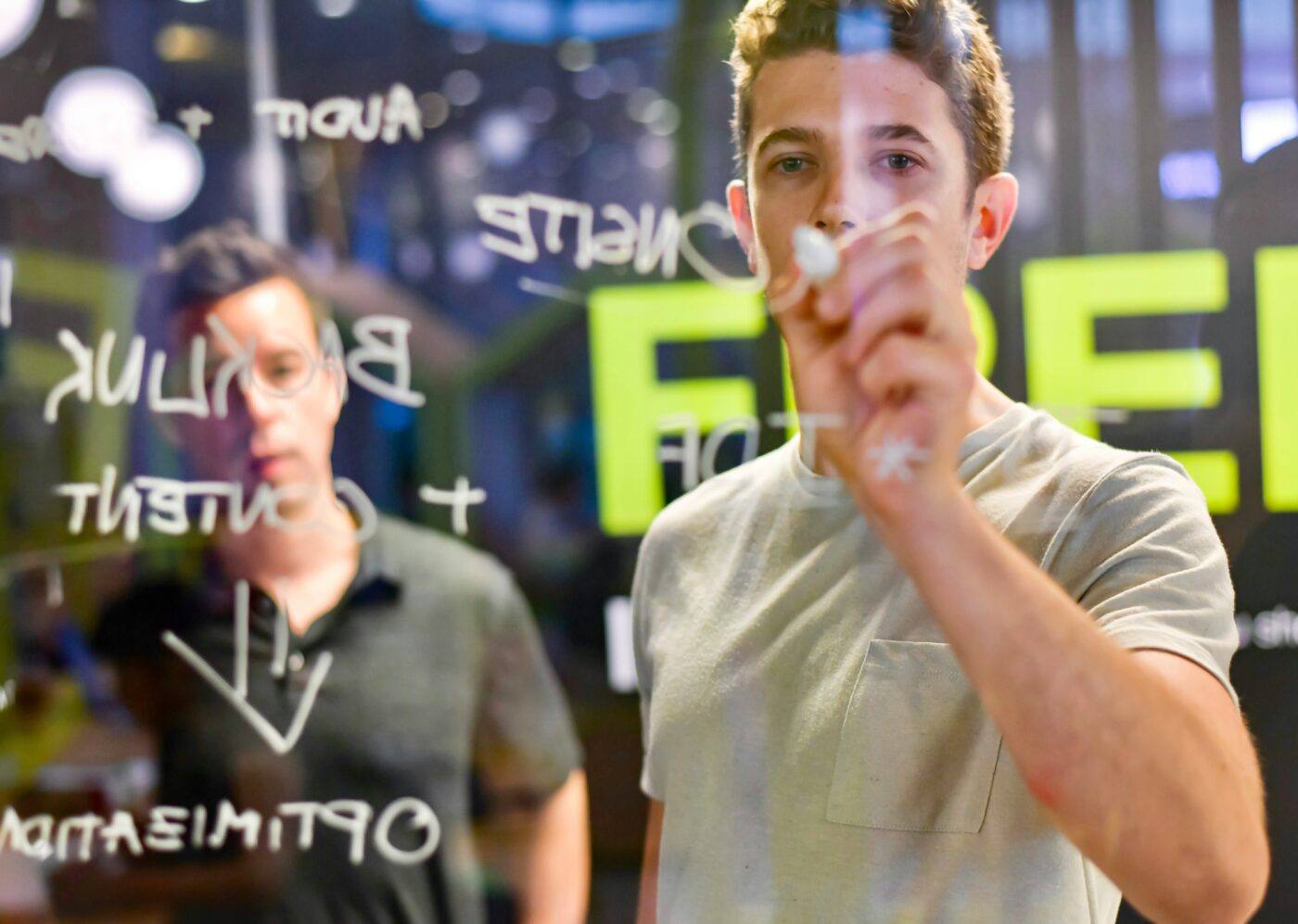

We create cutting edge, award-winning digital marketing campaigns

Questions?

Call us on 0330 353 0300, email info@koozai.com or fill out our Contact Form.

Hampshire Digital Marketing Agency Merlin House

4 Meteor Way

Lee-on-the-Solent, PO13 9FU, UK

Lancashire Digital Marketing Agency Cotton Court Business Centre

Church Street, Preston

Lancashire, PR1 3BY, UK

London Digital Marketing Agency Albert House

256 - 260 Old Street

London, EC1V 9DD, UK